Stocks, CFDs and Forex Trading Brokers

Which one is the best?

Why choosing the right broker matters?

Is the best

broker also fair broker?

Trading broker review process

Reviewing a trading broker is an important step before you choose one to handle your investments and trades. Here are some steps and factors to consider when reviewing a trading broker.

We rate Brokers on each factor on a scale of 1 to 10, with 10 being the best score. Broker with higher weighted average score may better meet your preferences and priorities.

Scoring example

Regulation and Licensing

This is a must, no discussion! Ensure that the broker is regulated and licensed by a reputable financial authority. Fair broker protects your investments and follows industry regulations.

Weight: 10Security

Check the broker's security measures for online transactions, data protection, and account safety. Look for brokers with robust encryption and multi-factor authentication.

Weight: 9Fees and Commissions

Evaluate the fees and commissions charged by the broker. This includes trading fees, account maintenance fees, deposit/withdrawal fees, and any other costs associated with using their services.

Weight: 9Trading Platforms

Examine the broker's trading platform and its user-friendliness. Ensure it provides the tools and features you need for your trading style and preferences.

Weight: 7Assets and Instruments

Assess the range of financial instruments offered by the broker, including stocks, bonds, forex, cryptocurrencies, commodities, etc. Choose a broker that offers the assets you wish to trade.

Weight: 8Customer Support

Look for brokers with responsive and efficient customer support. Check if they offer support through various channels like phone, email, or live chat.

Weight: 7Trading Execution

Look into the broker's trading execution speed and reliability. A broker with low latency and minimal slippage is preferable.

Weight: 9Leverage and Margin

If you plan to use leverage, understand the broker's leverage offerings and margin requirements. Be aware of the risks associated with trading on margin.

Weight: 6Selected Brokers

Check list of below trading brokers, read my comments and pick the one which suits you the best.

TD365.com - A dream come true for intraday traders!

One of its standout features is the fixed spreads, providing consistency in costs and eliminating surprises. The user-friendly, easy to use CloudTrade Platform makes trading really fast and with quick execution. Moreover, TD365's stellar support team is responsive and reliable, promptly addressing any concerns that may arise. With risk management tools like stop-loss and take-profit orders, intraday traders can trade with confidence. In summary, TD365 is highly recommended for its fixed spreads, simplicity, support, and risk management features. Highly recommended for all intraday traders trading manually!

Try This BrokerRisk warning: Financial Spread Bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 84% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

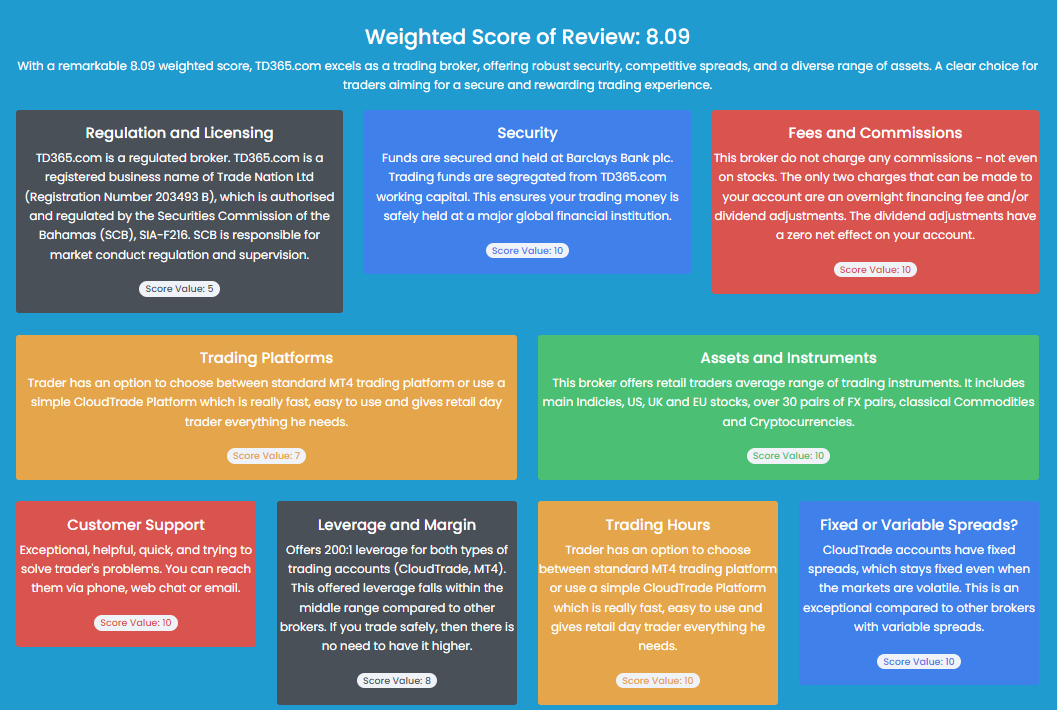

Weighted Score of Review: 8.09

With a remarkable 8.09 weighted score, TD365.com excels as a trading broker, offering robust security, competitive spreads, and a diverse range of assets. A clear choice for traders aiming for a secure and rewarding trading experience.

Regulation and Licensing

TD365.com is a regulated broker. TD365.com is a registered business name of Trade Nation Ltd (Registration Number 203493 B), which is authorised and regulated by the Securities Commission of the Bahamas (SCB), SIA-F216. SCB is responsible for market conduct regulation and supervision.

Score Value: 5Security

Funds are secured and held at Barclays Bank plc. Trading funds are segregated from TD365.com working capital. This ensures your trading money is safely held at a major global financial institution.

Score Value: 10Fees and Commissions

This broker do not charge any commissions - not even on stocks. The only two charges that can be made to your account are an overnight financing fee and/or dividend adjustments. The dividend adjustments have a zero net effect on your account.

Score Value: 10Trading Platforms

Trader has an option to choose between standard MT4 trading platform or use a simple CloudTrade Platform which is really fast, easy to use and gives retail day trader everything he needs.

Score Value: 7Assets and Instruments

This broker offers retail traders average range of trading instruments. It includes main Indicies, US, UK and EU stocks, over 30 pairs of FX pairs, classical Commodities and Cryptocurrencies.

Score Value: 10Customer Support

Exceptional, helpful, quick, and trying to solve trader's problems. You can reach them via phone, web chat or email.

Score Value: 10Leverage and Margin

Offers 200:1 leverage for both types of trading accounts (CloudTrade, MT4). This offered leverage falls within the middle range compared to other brokers. If you trade safely, then there is no need to have it higher.

Score Value: 8Trading Hours

Trader has an option to choose between standard MT4 trading platform or use a simple CloudTrade Platform which is really fast, easy to use and gives retail day trader everything he needs.

Score Value: 10Fixed or Variable Spreads?

CloudTrade accounts have fixed spreads, which stays fixed even when the markets are volatile. This is an exceptional compared to other brokers with variable spreads.

Score Value: 10Markets.com - A Solid Broker for Traders of All Levels

This broker offers a wide range of trading instruments, from stocks and forex to cryptocurrencies and commodities, making it a one-stop-shop for all trading needs. Intuitive platform, educational resources, and excellent customer support make it a go-to choice for traders of all levels. Competitive FLOATING spreads, low fees, and fast execution further enhance the trading experience. Highly recommended for all intraday traders trading manually or with MT4/5!

Try This BrokerRisk warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 79.1% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Weighted Score of Review: 7.74

Score 7.74 suggests a very solid option for traders with moderate experience.

Regulation and Licensing

Markets.com is a regulated broker, operated by Safecap Investments Limited ('Safecap'), which is regulated by the CySEC under licence number 092/08.

Score Value: 10Security

Funds are stored in BARCLAYS BANK PLC (at Leicester UK) or J.P. Morgan AG (at Frankfurt am Main, Germany)

Score Value: 10Fees and Commissions

Various fees are applied, like inactivity fee (10 USD per month), currency conversion fee set at 0.6%. There are no commission fees.

Score Value: 7Trading Platforms

Day trader has an option to use Web Platform or MT4 and MT5 alternatives. The Web Platform offers a user-friendly experience, enabling retail traders to execute trades with ease and comfort.

Score Value: 10Assets and Instruments

Full range of trading instruments is offered.

Score Value: 10Customer Support

Experieced, quick and also helpful. Available via phone, email and dedicated live chat.

Score Value: 10Leverage and Margin

Offers only 30:1 leverage for standard trading retail accounts. Leverage 1:30 is the maximum we offer for EU client as per the EU regulation. Professional accounts can get 300:1.

Score Value: 2Trading Hours

Forex: Sun - Fri from 21:00 till 21:00 (GMT) Indices, Metals: Sun - Fri from 22:00 till 20:59 (GMT)

Score Value: 10Fixed or Variable Spreads?

The Spreads are floating and therefore depending on liquidity and volatility.

Score Value: 0Risk Disclaimer & Warning

Reading content published on this website you accept the following terms and conditions

You are here entirely at your own responsibility. FairTradingBrokers is NOT responsible for your trades and your actions. This information is provided to you so that you can properly understand the services and products we provide and to assist you in deciding whether you wish to use our services and products. We are neither your financial advisor nor your financial planner and we do not provide analysis of your investment or other objectives, financial situation or your particular needs that a professional financial adviser or financial planner typically provides.

Any resources and materials that you may be provided with, or may access from us, are provided with the sole aim of enabling you to manage and control your own investments. This also means that you need to be able and willing to accept sole responsibility for ensuring the suitability of any and all investments that you may make, before making any investment or effecting any transaction with us.

Understand and respect that foreign exchange and derivatives trading can be very speculative and may result in losses. Foreign exchange and derivatives trading involves considerable risk and is not suitable for every investor.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 74-89% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Never trade with money you cannot afford to lose.

Frequently Asked Questions

Here are some of the answers you might be looking for.